Big Investors not shying away from Oil & Gas

Oct 14th, 19

An interesting article in the Guardian today for anyone interested in investing in Oil & Gas Exploration and Production. Not all of the big banks are shying away from the Industry under pressure from shareholders and investors. Of late; it would seem the big banks were all getting out of "Dirty" energy and chasing clean renewables.. but that isn't necessarily accurate.

Some big names in finance are pumping a lot of money into expanding the fossil fuel Industry. If you were looking to invest in current and future Oil & Gas projects and were under the impression it was not a good long-term investment, well they obviously disagree. These companies are investing heavily in fracking, coal mining, pipelines and Arctic Oil & Gas according to the article by Patrick Greenfield.

The article indicates that fracking projects in the Permian Basin are the focus of major financing, a top producing formation in the Oil & Gas Industry it is still attracting investor attention eager to tap into yet undiscovered reserves. Arctic Oil & Gas projects are also seeing an increase in financing, although not on the same scale as other fossil fuel sectors.

READ MORE by clicking on the link above "Big Investors not shying away from Oil & Gas"

Top investment banks provide billions to expand fossil fuel

industry

Patrick Greenfield Last modified on Sun 13 Oct 2019 16.32 EDT

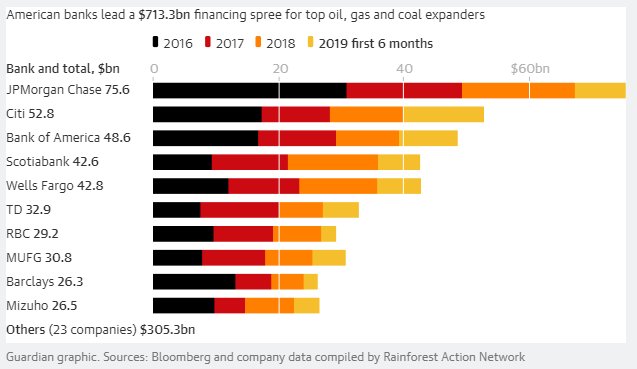

The world’s largest investment banks have provided more than $700bn of financing for the fossil fuel companies most aggressively expanding in new coal, oil and gas projects since the Paris climate change agreement, figures show.

The financing has been led by the Wall Street giant JPMorgan Chase, which has provided $75bn (£61bn) to companies expanding in sectors such as fracking and Arctic oil and gas exploration, according to the analysis.

The New York bank is one of 33 powerful financial institutions to have provided an estimated total of $1.9tn to the fossil fuel sector between 2016 and 2018.

The data shows the most aggressively expanding coal-mining operations, oil and gas companies, fracking firms and pipeline companies have received $713.3bn in loans, equity issuances and debt underwriting services from 2016 to mid-2019.

Other top financiers of fossil fuel companies include Citigroup, Bank of America and Wells Fargo.

Using Bloomberg financial data and publicly available company disclosures, the analysis was compiled exclusively for the Guardian by Rainforest Action Network, a US-based environmental organisation.

The figures update the group’s Banking on Climate Change 2019 report from April, which showed the practices of key investment banks were aligned with a climate disaster.

Figures show fracking has been the focus of intense financing, with Wells Fargo, JPMorgan Chase and Bank of America providing about $80bn over three years, much of it linked to the Permian basin in Texas.

The financing of the tar sands crude oil projects in Alberta, Canada, is dominated by the Canadian banks, led by the Royal Bank of Canada and Toronto Dominion.

The tar sands fields in north-west Canada are the third-largest known reserves of crude oil in the world, but extraction has caused widespread damage to ecosystems and forced indigenous communities from their homes.

Although financing levels are on a smaller scale than other parts of the fossil fuel industry, in the years since the Paris climate agreement there has been increased financing for oil and gas projects in the Arctic, led by JPMorgan Chase, which provided $1.7bn in 2016-18.

Extraction in the region is typically dominated by Russian firms such as Gazprom and Rosneft, about which there is less transparency in business data.

The largest American banks – JPMorgan Chase, Citi and Bank of America – lead financing for ultra-deepwater oil and gas projects that extract fossil fuels from 1,500 metres and below.

Deepwater projects have been the site of several disasters, including the BP Deepwater Horizon spill in 2010, in which 11 people died and billions of dollars’ worth of damage was done to local communities and businesses.

Barclays is one bank showing signs of change. While it remains a significant banker for the fossil fuel industry, its business with the companies most aggressively expanding in the sector has fallen sharply, from $13.1bn in 2016 to $5.2bn in 2018. The first-half figure for 2019 shows the bank is on track to record another annual decrease.

In response to the figures, JPMorgan, which has faced growing protests over its fossil fuel banking activities, said it recognised the complexity of climate change and actively engaged with stakeholders on the issue.

Wells Fargo said it carried out enhanced checks on its energy clients, which represented a small part of its overall business.