Peak Oil Crisis

THE HEART OF THE MATTER by C.J.CampbellThe Association for the Study of Peak Oil and Gas

Getting to the heart of the matter is not an easy task but we can at least try. It may help to open the attempt by defining some of the subjects to be covered. The Oxford Dictionary reveals that:

Economics is a branch of knowledge concerned with the production, consumption and transfer of wealth;

Geology is the science which deals with the physical structure and substance of the Earth, their history and the processes which act on them;

Politics are the activities associated with the governance of a country or area, especially the debate or conflict between individuals or parties having, or hoping to achieve, power.

History is the study of past events, particularly in human affairs.

We will touch on all four subjects, as so admirably defined. How might we try to get to the heart of the matter? We could study learned tomes, speak to experts, observe Nature. We could do all these things but let us imagine that it were possible to hold an objective judicial inquiry run by the highest judges in the land, to be flanked by the most penetrating of advocates to probe deeply into the evidence and assess the honesty, reliability and bias of the witnesses. In the real world, such an Inquiry would find itself under political pressure to deliver a comforting verdict. So, perhaps it is better just to imagine the agenda and outcome of such an Inquiry in the following way.

In the preamble, the presiding judge sets the main terms of reference, in short to determine the status of oil and gas depletion. He calls an Historian, as the first witness, to cover the importance of the subject and explain how the economic, social and political life of the past Century was influenced by an abundant supply of cheap oil-based energy. It turned the wheels of industry; provided the fuel for transport and trade; formed the raw material for a host of products, and, above all, had a critical role in agriculture, fuelling the tractor and furnishing essential nutrients. The judge observed that the population of the World increased six-fold exactly in parallel with oil production, suggesting a link. He asked the Inquiry to determine whether the economic growth of the past could continue, or whether supply constraints would arise affecting the very fabric of Man’s place on Earth. As he pondered his own question, he resolved to call in bishops and cardinals to address the moral aspects of the matter.

When the Inquiry reconvened after its initial sitting, the judge defined the main questions relating to the history of oil and gas discovery. For simplicity, he referred to the various hydrocarbon phases collectively as “oil”:

• How was it formed and found?

• Where was it found?

• What was found? - all the many different categories from tar-sand to gas-liquids

• How much was found?

• When was it found?

• Where was it found?

• What was found? - all the many different categories from tar-sand to gas-liquids

• How much was found?

• When was it found?

More witnesses were called, but each was required to explain his particular bias and vested interest, some being administered a truth drug before they took the witness stand.

The executives of oil companies explained how they had a fiduciary duty to sing to the stock market for the benefit of their shareholders, adding that it was simply not their job to explain the nature of depletion. The economists pointed out that the very foundations of their subject were at risk if they were to admit to resource constraints beyond the reach of market forces.

The exploration geologist admitted that his job had degenerated to the point of making purses out of sow’s ears in the hope of pleasing his employers and providing a livelihood. The politician explained that his voters wanted only good news, making it easier for him to react to a crisis, which could be depicted as an Act of God, than to prepare for one. The investment banker reported that his commissions would suffer if he were to offer anything other than an optimistic view of the future, admitting to no more than short cyclic downturns. The government official saw his role as encouraging exploration whatever the foreseeable outcome. The even-handed Cardinal reminded the Inquiry that Giordano Bruno had been put to death by the Pope on February 17th 1600 for doubting that the Earth was flat; and that Darwin had been accused of blasphemy for proposing evolution in terms of the survival of the fittest.

The judge summed up the session outlining three principal objectives:

• First, to establish an accurate record of past oil discovery and production;

• Second, to use that information to extrapolate future discovery and production;

• Third, to evaluate the impact on Mankind in the widest sense.

PART 1 - THE TRUE RECORD OF THE PAST

The Inquiry moved to the next phase of its work, hearing evidence on the following topics:

How was it formed and found

Experts spoke of sapropel, vitrinite, plate tectonics, global warming, migration paths, anticlines and fault-traps, seals……. and many other esoteric technical matters. Men with bronzed faces explained seismic surveys, drilling holes, even horizontal ones, coring, electric logs, semi-submersible rigs, and much more. Things called wildcats and dry holes were described. Drillers spoke of the Kelly Bushing and the rat hole, mentioning a piece of equipment, colourfully termed a Donkey’s Dick. Economists stepped forward to reveal the tax treatment, whereby operating costs were taken as a charge against taxable income, such that exploration was largely funded by the unconscious taxpayer. Lawyers spoke of concessions and expropriations. A man at the back of the room, with binoculars round his neck, explained that he was an oil scout, charged with collecting information on what was going on in a secretive industry.

Just before the session closed, a distinguish white-haired man in a grey suit rose to his feet, saying that Soviet research had proved that all the theories, which had been presented to the Inquiry, were erroneous. He claimed that in fact oil had originated in the primordial formation of the Earth, such that beneath each oilfield lay another awaiting discovery. An observer from a German institute rounded on him declaring that they had checked the occurrences of oil in crystalline rocks, the basis of the claim, finding that there were perfectly normal explanations in terms of lateral migration from conventional source-rocks. Many complex scientific and technical matters were covered, some with economic and political attributes and implications.

Where was it found?

Maps were laid before the Inquiry showing the locations of the World’s wildcats and dry holes, the concession boundaries and the discoveries. The judge remarked that it was evident that oil was unevenly distributed, noting that clusters of oilfields were separated by vast barren tracts, dotted with dry holes. He further observed that the entire World had been thoroughly explored, pointing out that much of the Southern Hemisphere seemed to be rather poorly endowed, no doubt for good geological reasons.

What was found?

Chemists and physicists described physical properties: the density and viscosity of oil; the bubble and dew points; the nature of asphalt, paraffin and wax. Photographs of free-flowing black oil pouring into a mud pit in the Middle East were compared with those of huge shovels excavating Canada to reach sands impregnated with sticky tar. The mammoth platforms in the stormy North Sea were compared with slender derricks in the desert sands. The energy expended in extracting the many different types of oil was tabulated. One expert explained his hopes to mobilise oil with catalysts in the reservoir, while another spoke of setting fire to oily shales underground. A Japanese delegate explained how his government hoped to extract methane from strange disseminated ice-like crystals in the ocean depths. A representative from the research community spoke of his pressing need for more money, saying that everything could always be studied more.

How much was found?

A Texan explained how the Securities and Exchange Commission had moved to prevent fraud by imposing strict definitions in the early days of oil in his State. The ownership of the oilfields, he said, was highly fragmented, such that each owner knew only about his own plot. For financial purposes, he was required to report as Proved Reserves only what he expected his current wells or developments to yield. The judge intervened to elucidate “By Proved, you mean in plain language Proved-so-Far, saying nothing about the ultimate size of the field as a whole?” The Texan nodded agreement. A French statistician spoke with his conviction that it was all a matter of Probability, mentioning histograms with mean, mode and median values. Explorers explained how they made good scientific estimates of the size of a prospect,

but had to exaggerate to secure the funds to drill. A Russian recalled the Soviet system of drilling for information without the pretence that every new borehole would make a

fortune. Engineers spoke of their challenges to balance investment against cash-flow, and

of phased developments which aimed to accelerate production to payout, followed by satellite and long-reach drilling to extend plateau production for as long as possible. An

economist reminded the Inquiry of the impact of discounted cash flow that encouraged

rapid depletion. An official from Norway told of the reporting procedures, saying that the

explorers’ estimates remained confidential, while the expected proceeds of each phase of

development was reported as it occurred, giving a comforting image of “reserve growth”. He revealed that if pressed, the engineers could readily anticipate the full future production from a field, no matter what it took to produce the last barrel, but were reluctant to do so. Most of the necessary techniques were already well known, so it was simply a matter of judgment to assess how they would be applied.

When was it found?

An explorer took the stand to say that he searched for prospects having the right characteristics to contain a viable oilfield. He claimed that the date of his recommendation for a successful venture marked the discovery date. A driller countered by saying that the field was found by the first successful borehole. An economist recoiled in horror saying that it only became a valid discovery when it delivered a profit, while the engineer said that the first production marked discovery. The judge summed up the debate, noting that a field contained what it contained because it had been filled in the geological past. He expressed the view that the most sensible approach was to attribute all the oil ever to be produced from the field to the completion of the first successful borehole, adding with a wry smile “you have to be born before you can have a life of any sort”. The bishops and cardinals nodded their agreement. The clerk of the Inquiry noted the implication of the judge’s findings, namely that all reported reserve revisions were to be backdated to the original discovery, which he felt would have far reaching implications when it came to establishing the trends.

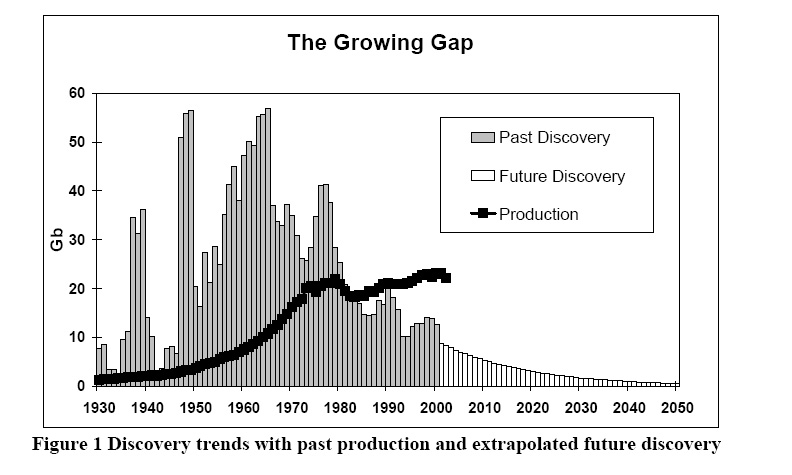

The deliberations went on for months as the tribunal searched for clarity in definitions, transparency in reporting, and cross-examined witnesses to discount their bias. At a certain point, it was decided that the Inquiry should itself travel to gain first hand knowledge of key oilfields. It wanted to understand more precisely the local conditions; conduct technical audits; and evaluate the local reporting practices. In particular, it examined the true nature of the huge upward reserve revisions reported by certain OPEC countries in the late 1980s, concluding that they were in part valid, but had to be backdated to the discovery of the fields concerned. They had been found as much as fifty years before. It went to Venezuela to agonise over where to set the boundary with Heavy Oil in respect of both past production and reserves. It travelled to Canada finding a different reporting practice because the cold conditions there affected the flow properties of heavy oil giving the practical need for a higher cut-off. Finally, the Inquiry published the first part of findings in a massive report, giving details of past production and estimated future production from known fields by basin, country and region. Wildcat drilling statistics were included as well. The cover carried a plot of past discovery, including a simple extrapolation for future discovery, with production superimposed (Figure 1).

PART 2- FORECASTING THE FUTURE

Armed with comprehensive information on the record of the past, the Inquiry moved on to evaluate various techniques for forecasting future discovery.

Abstract geological assessment couched in subjective probability

A representative from the United States Geological Survey explained its approach. Each geological basin had been identified and delineated. Skilled geologists had pondered the distribution of source-rocks, reservoirs and traps to determine the likely size and number of fields to be found. It was recognised that these were not measurable parameters but expressions of judgement subject to various probability rankings, themselves to be subjectively assessed. For example, it concluded that a little known basin in East Greenland had a 95% probability of containing more than zero, namely at least one barrel, and a 5% probability of containing more than 111.815 Gb (billion barrels), from which a Mean value of 47.148 Gb was computed. The judge queried if quoting the results of a subjective analysis of a little known place to three decimal places was justified. The official went on the explain how he had assumed that reported Proved Reserves in the United States were a fair estimation of the full-size of a field and set a pattern for what could be expected in other regions when they had been drilled as intensively.

The judge queried this conclusion pointing out that the Inquiry had found conflicting evidence, which showed that the experience of the early days in the United States, with its special commercial environment, was by no means representative of the World as a whole. He directed that only the low end of the USGS range could be taken seriously, especially as actual discovery seven years into the study period had fallen far below the average Mean value.

Creaming curves

The Inquiry paid particular attention to plots comparing discovery against wildcat drilling and over time. It noted that many basins demonstrated very firm trends of falling discovery, following a hyperbolic trajectory. Countries with more than one basin showed more than one such curve. The Inquiry concluded that these plots formed a robust method for forecasting future discovery, accepting the recommendation from an economist that there should be a cut-off before asymptote to exclude prospects too small to be viable under any foreseeable economic circumstance.

Parabolic Fractal

The Inquiry took evidence from a French expert who explained that the distribution of objects in a natural domain plotted as a parabola when size was set against rank on log scales. He demonstrated the relationship by showing that the larger towns determined the population of a country as a whole under a fractal law of self-similarity, whereby a complete segment of the distribution describes the whole. Applying the method to oil fields, he noted that the larger fields in any basin tend to be found first and that their distribution could be used to project the total. The difference between the parabolic fractal and what had been found represented the yet-to-find, subject again to an economic cut-off.

Discovery-Production Correlation

It was noted that discovery in most countries had peaked long ago, and that there was a general correlation between the pattern of discovery and the corresponding production after a time-lag. Accepting that oil has to be found before it can be produced, the Inquiry recognised that falling discovery must in due time be reflected in falling production. Accordingly, the extrapolation of past discovery formed a good basis for forecasting future production. Alternative methods of modelling with a Gaussian bell-curve (also known as a Hubbert curve) were noted.

Other Hydrocarbons

In addition to modelling Regular Oil (also known as Conventional), efforts were made to forecast production from the following categories:

Oil from coal and shale

Bitumen and synthetics

Extra-Heavy Oil

Heavy Oil (<17.5o API)

Deepwater Oil (>500 m)

Polar Oil

Natural Gas Liquids from gasfields and gas plants Natural Gas

Other gases (coalbed methane, gas from tight reservoirs, hydrates etc.)

The challenges of doing so were recognized, but the Inquiry did its best, giving emphasis to the engineering and economic factors governing extraction rate, which in most cases was more relevant than the size of the resource itself.The Inquiry recognized, above all, that the depletion of any finite resource had to start from zero on discovery and end at zero on exhaustion, reaching a peak in between. It concluded that peak would normally come close to the midpoint of depletion, when half the total endowment in Nature had been consumed. Furthermore, it noted that in the same way as a mountain range, made up of peaks and inter-montane valleys, appears as a single silhouette on the horizon, so the peak of oil production may not be a single event.

The Inquiry found that future production would be influenced not only by physical supply as dictated by discovery rate and the immutable physics of the reservoir but also by demand, which reflected economic and political circumstances, as well as oil price itself. It accordingly contemplated various alternative scenarios:

It accepted a base case scenario that distinguished three groups of country:

• Post-midpoint countries - where production is expected to decline at the

current Depletion Rate (annual production as a percentage of future

production).

• Pre-midpoint countries - where production might still rise, depending on local

circumstances. Since most such countries are now close to midpoint, the

assumptions are not perceived to be very critical.

• Swing countries - the five main producers of the Middle East (Abu Dhabi, Iran, Iraq, Kuwait and Saudi Arabia, including the Neutral Zone) are treated as swing producers around peak, making up the difference between World demand and what the other countries can produce.

The scenario assumes that the demand and production of Regular Oil are on average flat to 2010 because of recurring recessions caused by price shocks that arise when capacity limits are successively breached. It further assumes that the Swing Countries can not in practice offset decline elsewhere beyond 2010, when they would be supplying about forty percent of the World’s needs. World production thereupon commences its terminal decline at the then depletion rate of about 2.5% a year. The judge pointed out that under this scenario, production actually peaked in 2000, a few years before the indicated midpoint of depletion in 2005, which seemed a normal relationship being also experienced in mature countries, such as Germany.

The Inquiry examined other scenarios, noting that if production could be somehow stepped up, peak would be higher and sooner, giving a steeper subsequent decline. On the other hand, if military actions in the Middle East curbed production causing a price shock and reduced demand, then the plateau might last beyond 2010, or the decline might set in earlier. These scenarios apply only to Regular Oil.

It was recognized that gas would be a partial substitute for oil, but it was noted that gas

depletes very differently from oil. More has been generated in Nature than was oil, but more also escaped from imperfect seals to the reservoirs. An uncontrolled well depletes a gas accumulation very quickly, so in practice gas has been commonly produced to deliver a long plateau, with most fluctuation being seasonal. In effect, production during the plateau period drew down the inbuilt spare capacity. In an open market with gas being traded on a daily short-term basis, the end of the plateau comes abruptly without warning market signals, it being cheaper to produce the last cubic foot than the first. The Inquiry speculated that the United States was experiencing such a collapse now, and that Europe’s gas supply from the North Sea was due to fall sharply.

The Inquiry recognised the difficulties of modelling the global supply of gas, because it is so dependent on the construction of long-distance pipelines and contractual arrangements, which are not easily foreseeable. But it did tentatively assume a plateau of production at 130 Tcf/a from 2015 to 2040, followed by steep decline. The production of Natural Gas Liquids was expected to rise and fall in parallel, possibly with some increase in yield from new technology.

The findings of this part of the inquiry were summed up by the graph in Figure 2. So far as Regular Oil is concerned, the key parameters in rounded numbers are as follows:

Past production 900 Gb

Future Production 1000 Gb

From known fields - 875 Gb

From new fields - 125 Gb

Total 1900 Gb

It was accepted that the forecast therein projected would prove wide of the mark as many unpredictable short-term factors would almost certainly intervene. However, it was concluded that the departures would not be very great, and that the model was a useful point of departure from which to assess the general consequences for Mankind in Part 3. It drew attention, in particular, to a certain self-adjusting feature of the model whereby short-term departures would be balanced by higher or lower depletion rates for the remainder.

PART 3. THE CONSEQUENCES FOR MANKIND

After more than a year of detailed investigations, taking evidence far and wide, searching for the truth amidst conflicting viewpoints and vested interests, the Inquiry braced itself for its most challenging task. That was to determine what the depletion of oil and gas meant for Mankind and what practical steps might be taken to ameliorate any adverse consequences. The judge decided to bring in philosophers, moralists, Church leaders, thinkers, leaders, and representatives of all walks of life. It was recognised that new ground had to be covered that went beyond conventional mindsets and academic structures. There was room for the intuitive common sense of a farmer from West Cork.

This part of the Inquiry opened with a review of the dependency of the modern world on oil for almost all aspects of life. It then moved on to analyse the bedrock of economic theory. That in turn prompted a review of the underlying criteria behind government policy and the democratic process, also called spin. From there, the debate led to the identification of the attitudes and aspirations of people in their daily lives touching on issues of morality in its widest sense. In particular, the morality of profiteering was evaluated, recognising that morality and the common good often ran in parallel. The Cardinals offered their spiritual insights. New-wave economists sought to integrate the hidden environmental costs into the framework of market economics.

It was found helpful to compare modern attitudes and aspirations with those prevailing under different past circumstances, as for example obtained in wartime Britain, when basic needs were in short supply, and when the open market was replaced by a policy of central control, aimed to allocate fair shares of what was available. Many weeks and months of fruitful investigation passed before the presiding judge made his summing up. He was able to synthesis the conclusions into a few key points which he listed as follows

1. Peak Production:

The Inquiry finds that the World production of Regular Oil will reach a peak during the first decade of the 21st Century, and that the production of all liquids will do

likewise around the end of the decade. Such a peak reflects the immutable physics of the reservoir and the rate of past discovery, being virtually immune to economic or technological developments.

2. Subsequent Decline:

The Inquiry finds that economic and technological developments may affect the rate of ost-peak decline and stimulate the entry of substitutes from so-called renewable energies, including safe nuclear energy.

3. Conflict:

The Inquiry notes that the uneven distribution of future production and demand gives serious grounds for conflict as consumers vie with each other for access to supply, principally from the Middle East.

4. Economic Impact:

The Inquiry notes that a decline in the supply of cheap oil-based energy will have an unavoidable and far-reaching impact on the economic prosperity of the World, especially in respect of trade and food supply. It may on the other hand have a positive impact on the environment generally. For example, climate change concerns might evaporate from reduced emissions, and fish-stocks might recover when trawling gave way to less energy-intensive drift netting.

5. Options:

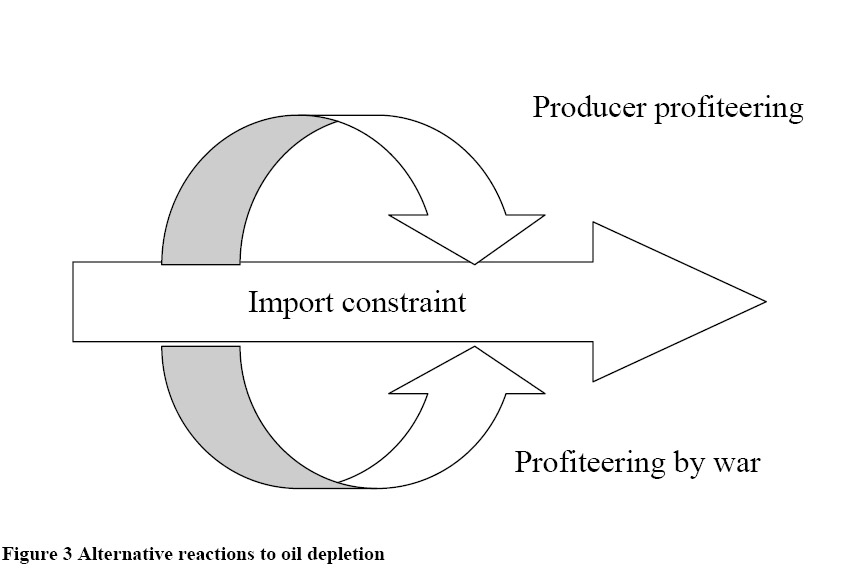

The Inquiry concludes that the World had three main options in addressing the issue (see Figure 3). Two are short-term options with negative attributes, but in the longer term all three paths come together to reflect the eventual depletion of oil, which is far beyond Man’s control, being imposed by Nature.

The identified options are as following, being graphically illustrated in Figure 3:

a) National Profiteering

Under this option, oil resources remain within the national jurisdiction of the producing countries, allowing them to profiteer from the scarcity value of their oil as World shortages bite in earnest from 2010 onwards. It is feared that such profiteering could lead to excessive military expenditure, or reinvestment in foreign industrial countries, leading to large-scale transfers of ownership, which would be causes of predictable tension. Furthermore, the profiteering would likely cause World recession that might indirectly act to the detriment of the profiteer. National profiteers would also suffer in the longer term because they would be less prepared to meet the consequences of the inevitable exhaustion of their natural inheritance.

b) Profiteering by War

Under this option, one or more major consuming countries use their military might to take control of oil production, wherever it might lie, with a view to profiteering from such control, both directly from the sale of conquered oil and indirectly by stimulating their home economies with cheap energy. If world production were stepped up under this arrangement, the global peak would be higher and sooner, meaning that the subsequent decline would be steeper,

making a bad situation worse. While this too might convey short-term benefits, it left the conquerors less prepared to cope with the inevitable decline imposed by Nature, which would be even steeper as a result of the higher near-term level of production.

c) Consumer Restraint

The third option contemplates a Depletion Protocol whereby the importers of oil would curb their imports to match the global Depletion Rate, as imposed by Nature, which is currently running at about 2.5% year. By matching demand with supply, World prices would remain in reasonable relationship with production cost, removing profiteering, which was held to be morally wrong. It would mean that the poor countries would be able to afford their minimal

requirements. It would also means that the massive destabilising financial transfers arising from particularly Option a) would be avoided. The importing countries could manage their allocations as suited their particular environments and inclinations. They might auction the supply to the highest bidder under open market principles; they might tax oil higher with corresponding reductions of other taxation; they might ration supplies, such rations being perhaps tradable; or they might employ a combination of such measures.

The Inquiry concluded that this option provided the smoothest transition to the new world of reduced energy supply. It would encourage the avoidance of waste and provide for the entry of renewable energies to the maximum extent possible. It further concluded that there would be many indirect consequences leading to the encouragement of local communities and markets which might carry hidden benefits in that people would find themselves in better harmony with themselves, each other and their environments. The Cardinals in particular saw great scope for a spiritual re-awakening.

The Inquiry’s terms of reference did not require it to formulate any specific recommendations, but its report became the central theme of political and social debate throughout the World.